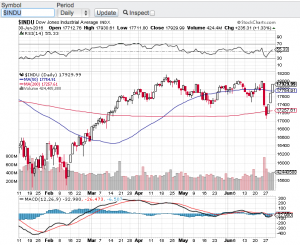

Despite the ongoing geopolitical risks and the U.S economy not expanding as projected, stocks continued their upward trajectory with the Nasdaq hitting an all time high last week. Last week the Nasdaq (chart) closed up 2.3%, the Dow Jones Industrial Average (chart) closed up 1.9%, the S&P 500 (chart) closed up 1.5% and the small-cap Russell 2000 (chart) also closed last week up 1.5%.

The Nasdaq’s record surge was prompted by strong earnings especially from the likes of Alphabet Inc. Symbol: GOOGL (chart) and Amazon.com Inc. Symbol AMZN (chart). Both companies which is weighted heavily on the Nasdaq reported soaring revenues and profits. Overall this earnings reporting season is coming in better than expected which is also playing a key role in buoying the markets. Stocks also got a boost last Monday when the outcome of the first round of the French elections came in as expected. This result did put pressure on gold (chart) which is viewed as part of the “safety trade”. Although gold has been down recently it has managed to stay above its 200-day moving average (see chart below).

This week corporate America will continue to release their earnings results with all eyes on Apple Inc. (NasdaqGS: APPL) which reports their results tomorrow, Pfizer Inc. (NYSE: PFE) comes forward this week as well as Facebook Inc. (NasdaqGS: FB), Pioneer Natural Resources, (NYSE: PXD), Telsa Inc. (NasdaqGS: TSLA), Time Warner Inc. (NYSE: TWX), Yum! Brands Inc. (NYSE: YUM), Apache Corp. (NYSE: APA), Consol Edison (NYSE: ED), Marathon Oil (NYSE: MRO), Occidental Petroleum (NYSE: OXY), Randgold Resources (NYSE: GOLD), BioMarin Pharma (NasdaqGS: BMRN) and Moody’s Corp (NYSE: MCO) just to name a few.

So as you can see there are still many more key earnings reports coming out which should continue to play a role in how the indexes fare. That said, I still am favoring the gold trade with gold holding above its 200-day moving average and the geopolitical risks that are omnipresent. Good luck to all 🙂

~George