With how hot tech stocks have been lately, one has to ask are the key indexes out of balance? Let’s take a look. It is no secret tech stocks have been on fire, the Nasdaq Composite (see chart here) has been setting records weekly. Stocks like Tesla, Apple and Amazon continue to set all time highs. Price to earnings ratios aka the P/E ratio are also expanding to levels not seen since the tech bubble of the early 2000’s. I am not suggesting that tech as a whole is in a bubble, but there can be an argument that certain tech stocks are. I am not singling out Tesla at all, but what I am highlighting is the company’s eye-popping 1000 + P/E ratio. The price to earnings ratio is a metric for valuing a company that measures its current share price to its earnings per share. For example the S&P 500 typically trades in the 15-20 P/E range. Yes, a 15 to 20 P/E multiple is the historic price to earnings multiple that the S&P 500 trades at. So when you look at Tesla and see that this company’s P/E ratio is currently over 1000, it does bring pause and perspective into the mix.

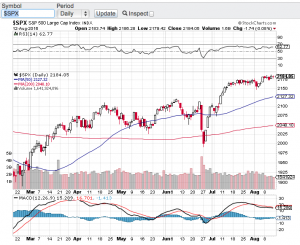

Back to the indexes that appear to be out of balance. As the S&P 500 (see chart here) and the Nasdaq Composite (see chart below) continue to set records, the majority of stocks have not returned to their pre COVID highs and still remain down on the year. This to me is something to pay attention to. Sure, some tech stocks deserve their current valuations due to how they are growing and benefiting from the widespread lockdowns. Tech stocks and the technologies they provide are serving businesses and consumers alike in a way no one would of thought of before the pandemic took hold of our country. However, even stocks like Apple have high seen quite the expansion of its P/E multiple which is currently trading at 39. Bottom line for me, as we are setting records each week, I would prefer to see a broader base rally to ensure that we are not out of balance with each and every record that is being set.

Good luck to all 🙂

~George