Earnings reporting season begins in earnest this week which could play a role in determining whether or not the bull market has more room to run. This past Friday the money center banks kicked off the reporting season as JP Morgan Chase (NYSE: JPM) and Bank of America (NYSE: BAC) recorded eye popping profits while Wells Fargo (NYSE: WFC) continues to deal with the aftermath of the “fake-accounts” debacle that rocked the bank last year.

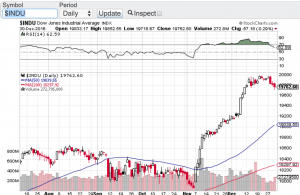

As I look at the charts of the key indexes, I do see a potential technical catalyst looming. The Dow Jones Industrial Average (chart), the S&P 500 (chart) and the small-cap Russell 2000 (chart) all share similar and current chart patterns. Over the past month or so, these key indices have been consolidating and trading in a tight range and when you have a looming catalyst such as earnings reporting season, most likely this pattern will breakout or breakdown. The Nasdaq (chart) does not fit this consolidation profile yet as it has been making new highs and leading the pack so far this year. Another technical set-up I look for is overbought or oversold conditions. Seemingly we have been in overbought conditions since the election but technically we are not according to the relative strength index also known as the RSI.

In my previous blog I did write about my expectation of increased volatility as we headed into January and earnings reporting season and how to hedge yourself against such volatility. To my surprise, vol has remained relatively low so far, however, there are catalysts looming as described above. As far as protecting a portfolio against any future volatility, there are many ways to do so but the most effective and simplest way is to buy S&P 500 puts. Especially while vol is low and premiums are relatively cheap. So if you have a “long only” portfolio buying some protection in the form of S&P 500 put options might not be a bad idea. Of course it is always best to consult a certified financial planner(s) before making any investment decisions or any adjustments to your current portfolio. My goal is to bring light to strategies that can be helpful to you that certain managers might not cover.

Good luck to all 🙂

~George