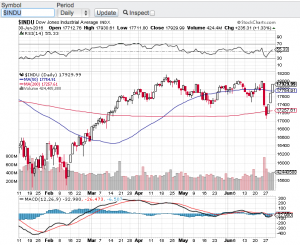

The major averages in December entered into bear market territory and seemingly was heading even lower. But lo and behold and fast forward to today and we see that the key indices have all come roaring back. The definition of a “bear market” is when a stock or an index goes down 20% or more from its highs and that was definitely the case in the second half of 2018. The Dow Jones Industrial (see chart here) is now back over 24,000 after dropping below 22,000 in December, the S&P 500 (see chart here) is back over 2,600 after dropping below 2,400, the Nasdaq Composite (see chart here) is now over 7,100 after hitting a low of 6,190 and the small-cap Russell 2000 (see chart here) it trading above 1,400 after hitting a low in December of 1,267.

The sharp V shaped bounce back in such a short period of time is very impressive. I do not think anyone expected such a sharp rebound in just a month. This surprise move is also happening despite the ever increasing chaos and turmoil out of Washington DC. Is it me or has it gotten to the point of utter disgust with what is happening to our country. I am not much of a political advocate in either direction but the narcissism and antics coming out of DC is unbelievable. What’s more is that they are using the government shutdown as the pawn to get their way, again unbelievable.

Ok enough of that and back to the markets. We are now heading straight into earnings reporting season and to me this without a doubt will be a significant catalyst as to whether or not stocks will continue to rise or pause. Of course any type of meaningful progress with the trade war and China could also play a major role. The Federal Reserve has been more vocal with interest rates and indicating that they are more apt to more of a wait and see approach as to any additional rate hikes in near term. There is a lot at hand here which should determine whether or not this bounce back rally will continue. Good luck to all 🙂

~George