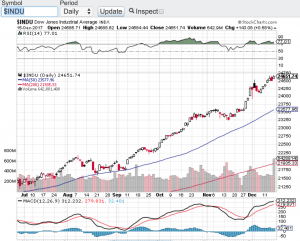

December is historically a strong month for the stock market. Many factors play into the last month of the year being a positive one including holiday bonuses, the general overall feeling of optimism and typically lighter volumes due to the holiday season. How we finish out this year will largely hinge on the results of this weekend’s G20 summit. Early indications are that the trade talks and other collaborative measures are going well. As the major averages enter into the last month of the year, The Dow Jones Industrial Average (click here for chart) finds itself at 25,538, the S&P 500 (chart) closed out the month of November at the 2,760 level, the Nasdaq Composite (chart) finished at 7,330 and the small-cap Russell 2000 (chart) finished November at 1,533. On the year, the major averages are barely in the green with the small-cap Russell 2000 actually a tad in the red.

Stocks this past week did get a boost from Federal Reserve Chairman Jerome Powell when Chairman Powell spoke at the Economic Club of New York. Chairman Powell stated that the Fed’s benchmark interest rate was now “just below” the neutral level. This sent the Dow Jones Industrial Average (see chart below) soaring over 600 points on Wednesday. Chairman Powell’s comments are being viewed by the street that the Federal Reserve just might be done raising interest rates for the foreseeable future. Now if we can get some concrete positive news and developments out of the G20 summit which is being held in Buenos Aires, then indeed we could be setting up for a year-end rally.

Let’s take a look at the moving averages technical set-up of the aforementioned key indexes starting with the Dow Jones Industrial Average (chart). At Friday’s close, the Dow is trading above its 200-day moving average by about 400 points while the S&P 500 (chart) closed right at its 200-day. Both the Nasdaq Composite (chart) and the small-cap Russell 2000 (chart) are trading below their respective 200-day moving averages but they have recently cleared and are trading above their 20-day moving averages. So technically speaking things do not look too shabby. Let’s see if we can have a rally into year-end.

Good luck to all 🙂

~George