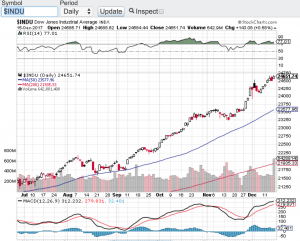

The 200-day moving average is in play! Last week, the Dow Jones Industrial Average (see chart here) breached its 200-day moving average. What does this mean? Well from a technical standpoint the 200-day moving average is one of the more respected support lines when it comes to indexes or stocks. A breach of the 200-day is not what the bulls want to see. The same rings true when stocks or indexes breakthroughs and breaks out above this key technical indicator. When this occurs, it is typically viewed as bullish. Unfortunately, this is not the case today. As mentioned above, the Dow Jones Industrial Average breached its 200-day and closed the week below this support line.

Now before this draws too much attention or significance, these types of technical breaches can be short lived to only recapture this key technical support line and resume its upward trend. We will have to see if this is the case here. Why this technical breach isn’t too alarming yet, is because when I look at the broader markets such as the S&P 500 (see chart here) and the Nasdaq Composite (see chart here) both remain above their respective 200-day moving averages. The same cannot be said for the small-cap Russell 2000 (see chart here). Like the Dow Jones Industrials, the small-cap Russell 2000 also is trading below its 200-day.

So now what? As we head into the month of October, I can say with confidence that the markets will not hang around wondering which direction to take. A breach is a breach, either it follows through and continues its downward trend, or the breach is short lived only to resume its upward trend. One of the upcoming catalysts that will impact the markets is the 3rd quarter earnings reporting season and this my friends will be a determining factor as we head into year-end.

Good luck to all 🙂

~George