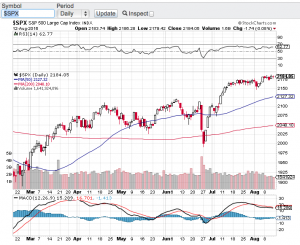

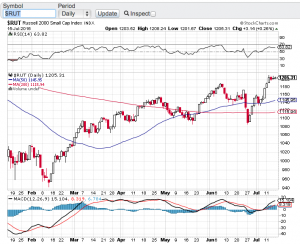

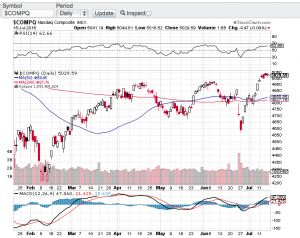

In my November 1st blog, I asked the question was the bounce real? Fast forward to today and indeed the bounce the markets experienced in the early fall not only held but took off to and are nearing all-time highs. The Dow Jones Industrials (see chart here) closed yesterday at 36,245, the S&P 500 (see chart here) closed at 4,594 the Nasdaq Composite (see chart here) closed at 14,305 and the small-cap Russell 2000 (see chart here) finished the month out at 1,862.

It’s truly incredible to see how resilient the markets are considering the current interest rate environment and how inflation continues to impact the consumer. Rising interest rates tend to impact the stock market negatively and inflation impacts the consumer negatively too. So why are the markets approaching all-time highs? Could it be that the economy grew at a faster rate in the 3rd quarter than previously reported? Or could it be that the Federal Reserve may be ready to slow down or pause its current interest rate policy? I am not sure on either front, but what is apparent is that the markets are brushing off the current backdrop of Fed’s economic policy and the ongoing inflationary pressures. One thing I have learned over the years is the trend is your friend and these markets continue to trend up.

That being said, let’s look at a key technical indicator that many traders and investors rely on to see if we are approaching or at overbought conditions. According to the Relative Strength Index aka the RSI both the Dow Jones Industrial Average (see chart here) and the S&P 500 (see chart here) have crossed and are trading above the 70 value level. The 70-value level according to the relative strength index is the beginning of overbought conditions. The Nasdaq Composite (see chart here) and the Russell 2000 (see chart here) are fast approaching the 70-value level. I do want to point out that stocks and indexes can remain overbought for extended periods of time, but I would not be surprised if we see somewhat of a pause or possibly a reversal here in the month of December to this very impressive rally we are currently in.

It’s always a good idea to consult a certified financial advisor before making any adjustments to your portfolio. Good luck to all 🙂

~George