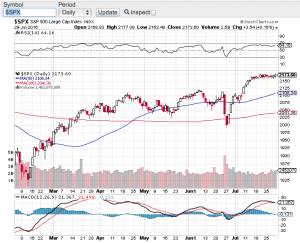

The month of May was a mixed month for stocks and the major averages. The Dow Jones Industrial Average closed out the month down 3.5% (see chart here) while the S&P 500 (see chart here) and the Nasdaq Composite closed the month out in the green. The small-cap Russell 2000 (see chart here) like the Dow closed the month out lower. Not bad considering how the debt ceiling issue and debate has been in the news seemingly hourly as everyone waits with bated breath as to what Congress will do. To me I wonder why this drama about raising the debt ceiling so the government can pay its debt and obligations is always a thing? Why even have a debt ceiling when there is no way United States of America could ever default on its debts and obligations. If this was to occur a global meltdown like never before seen could occur. How about this concept? No debt ceiling at all and instead vote in a fiscally responsible administration and politicians to manage our country’s finances properly. Sounds simple enough, but who am I kidding. Ok, enough of this and back to the markets.

Despite being an historically softer month for the stock market, May did not perform too bad as evidenced above. Yes, a mixed bag, but I think investors are happy to see that we didn’t fall off a cliff. That being said, as a look at the technical shape of the aforementioned indexes what is standing out to me is how key support lines are in play. The Dow Jones Industrial Average (chart) is hovering right around its 200-day moving average, while the S&P 500 (chart) is currently being supported by its 20-day moving average. The Nasdaq Composite (chart) is trading nicely above it’s 20, 50 and 200-day moving averages while the small-cap Russell 2000 (chart) is bouncing around its 20-day MA.

Lastly, I think the markets are in a position to continue its recent trading patterns and as soon as the final vote comes in on the debt ceiling matter, everyone will breathe a sigh of relief.

Good luck to all 🙂

George