It’s two days to go before our country’s Presidential election takes place. I think most everyone now is exhausted by the process. How many more commercials can be displayed? How many more rallies can we take? What’s more is I think we have all had enough of the bashing and trashing that is going on and quite honestly this type of behavior is unbecoming of our great nation. Thank goodness this is almost over.

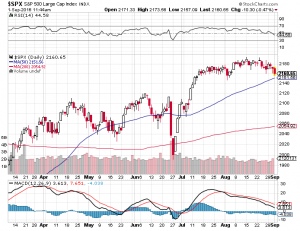

What has impressed me the most is how the markets have held up especially with all that is going on in our country. Yes, over the past couple of weeks the major averages have had a noticeable pullback. However, with the election at the forefront of everyone’s minds and the pandemic reaching all time highs, I have to ask myself why haven’t we seen a 20% or more correction? Instead we find ourselves in the midst of a 7-8% pullback. One of the answers very well may be how the averages are responding to their key technical support levels. Let’s first look at the Dow Jones Industrial Average (see chart here). On Friday, the Dow Jones on a intraday basis temporarily breached its 200-day moving average which is at the 26263 level. Then this bellwether average bounced sharply off of its support to close at 26501. Time and time again we have seen how important key support levels are to the markets and this was text book action pertaining to support levels at work. Friday was the perfect intraday response in how the Dow Jones Industrial Average responded to its 200-day moving average.

Now let’s take a look at the Nasdaq Composite (see chart below). On Friday, the Nasdaq essentially closed right at its 100-day moving average. So we will see this week whether or not this particular support line holds true to form. There are instances to where I have seen support levels breached for a few days or so and then respond. Whatever the case is, I am impressed with how the overall markets have weathered the backdrop of the current environment we find ourselves in.

Good luck to all 🙂

~George