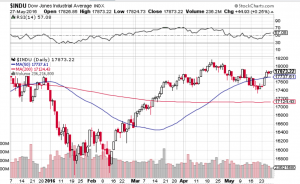

Stocks took off in the first quarter with the S&P 500 (see chart here) delivering its strongest Q1 performance in 5 years gaining over 10%. The Dow Jones Industrial Average (see chart here) also closed Q1 with a gain of 5.6%, the Nasdaq Composite (see chart here) finished the quarter up over 9% and the small-cap Russell 2000 (see chart here) finished up around 5%. So, as I posted last month, stocks continue their record setting ways.

So why are the markets continuing to demonstrate strength despite interest rates remaining high relative to when this bull market started? I think part of the answer is right there. The Federal Reserve is continuing to indicate that three interest rate cuts remain in place for 2024 which is bullish for the markets.

Another first quarter driver of the markets can be attributed to the “Magnificent 7”. Nvidia (Symbol: NVDA), Meta Platforms (Symbol: Meta), Amazon (Symbol: AMZN), Microsoft (Symbol: MSFT), Alphabet (Symbol: GOOGL), Apple (AAPL) and Tesla (TSLA) are the Magnificent 7 and are responsible for 40% of the S&P 500’s (see chart here) gain in Q1. This dynamic too attributed to the momentum stocks witnessed in the first quarter although there are a couple of chinks appearing in the armor of the Magnificent 7 and that is the recent under performance of Apple and Tesla. Personally, I would like to see a broader rally here not just 7 stocks that are making up a big percentage of the overall gains.

That being said, and now that the first quarter of the year is in the books, earnings reporting season begins here in April. Earnings season should be the next catalyst as to where stocks and indexes go. As I just spoke to, I would like to see a broader based rally and Q1’s earnings results just might deliver results that could extend this year’s impressive rally. However, if corporate America issues flat to softer results, we could see a pause in this rally and even a potential pullback.

Good luck to all 🙂

~George